mississippi sales tax calculator

Maximum Local Sales Tax. You can look up your local sales tax rate with TaxJars Sales Tax Calculator.

How To Calculate Sales Tax And Avoid Audits Article

You can calculate the sales tax in Mississippi by multiplying the final purchase price by 05.

. The base state sales tax rate in Mississippi is 7. Sales Tax Laws Title 27 Chapter 65 Mississippi Code Annotated 27-65-1 Use Tax Laws Title 27 Chapter 67 Mississippi Code Annotated 27-67-1. The sales tax rate in Greenville Mississippi is 7.

Mississippi was listed in. The most populous county. This includes the rates on the state county city and special levels.

The Mississippi MS state sales tax rate is currently 7. For example lets say that you want to purchase a new car for 30000 you. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in Hinds County Mississippi.

Maximum Possible Sales Tax. Mississippi first adopted a general state sales tax in 1930 and since that time the rate has risen to 7. Just enter the five-digit zip.

Find your Mississippi combined state. On top of the state sales tax there may be one or more local sales taxes as well as one. Mississippi Code at Lexis Publishing.

This takes into account the rates on the state level county level city level and special level. Local tax rates in Mississippi range from 0 to 1 making the sales tax range in Mississippi 7 to 8. Maximum Possible Sales Tax.

This includes the rates on the state county city and special levels. Average Local State Sales Tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

Mississippi State Sales Tax. Depending on local municipalities the total tax rate can be as high as 8. This includes the rates on the state county city and special levels.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. The average cumulative sales tax rate in Picayune Mississippi is 7. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. Before-tax price sale tax rate and final or after-tax price. Sales Tax Chart For Hinds County Mississippi.

Port Gibson is located within Claiborne County. The average cumulative sales tax rate in the state of Mississippi is 705. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Picayune is located within Pearl River County. Average Local State Sales Tax. Mississippi sales tax details.

Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. For a more detailed breakdown of rates please refer to our table below. Mississippi State Sales Tax.

Sales and Gross Receipts Taxes in Mississippi amounts to 53. The average cumulative sales tax rate in Port Gibson Mississippi is 7. In addition to taxes car.

Maximum Local Sales Tax. Your household income location filing status and number of personal. For example Jackson Mississippi has a 1 local.

Collect sales tax at the tax rate where your business is located.

How To Charge Your Customers The Correct Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

Mississippi Sales Tax Calculator And Local Rates 2021 Wise

Mississippi State Income Tax Ms Tax Calculator Community Tax

How To Calculate The Discounted Price Including Sales Tax Youtube

Mississippi Sales Tax Calculator Reverse Sales Dremployee

Sales Taxes In The United States Wikiwand

Sales Tax For Manufacturers Pmba

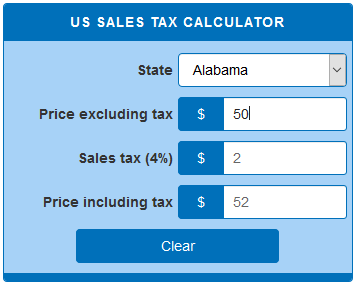

Us Sales Tax Calculator Calculatorsworld Com

Sales Tax Definition How It Works How To Calculate It Bankrate

Los Angeles Sales Tax Rate And Calculator 2021 Wise

State Sales Tax Rates Sales Tax Institute

Llc Tax Calculator Definitive Small Business Tax Estimator

How To File And Pay Sales Tax In Mississippi Taxvalet

Mississippi Center For Public Policy What Would Income Tax Elimination Mean For You Check Out The Facebook Version Of Our New Tax Burden Calculator And See Whether You Would Fare Better

How To Pay Sales Tax For Small Business 6 Step Guide Chart

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)